PropertyShark’s latest foreclosure report continues with expanded coverage across the broader New York metro area, including 12 New York and 12 New Jersey counties. Overall, the start of 2025 brought the slowest first quarter in five years as first-time foreclosures dropped 7% Y-o-Y to1,503 cases.

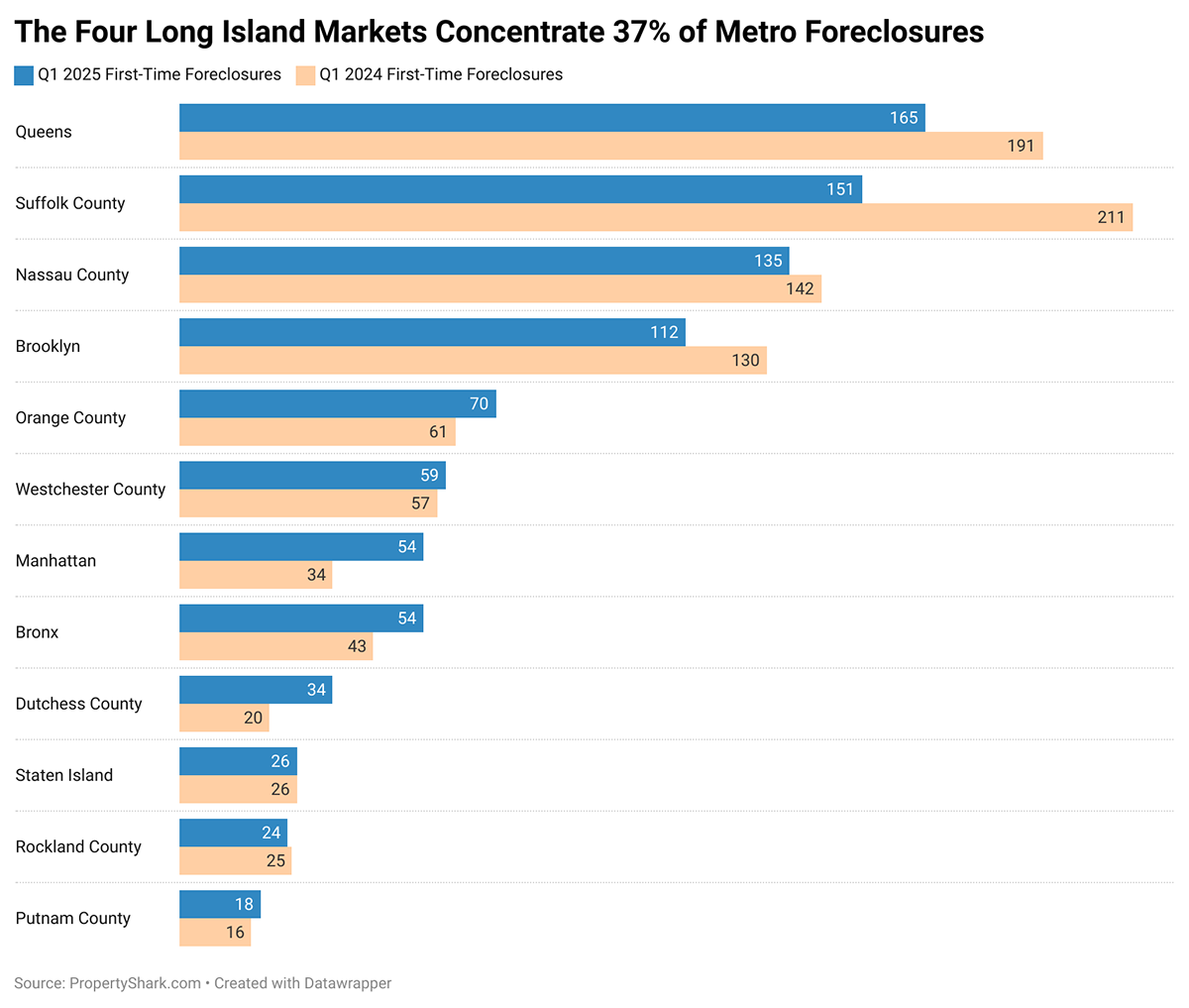

This was fueled by the decrease in filings in nearly half of the metro’s 24 counties, including its four most active markets: Queens, Suffolk County, Nassau County and Brooklyn, which claimed 37% of the metro’s caseload.

Here are some more highlights:

- Suffolk County was the second most active market in the metro, with 151 cases resulting from a 28% Y-o-Y drop

- Nassau County had the third highest number of foreclosures in metro New York, logging 135 first-time filings despite a 5% Y-o-Y drop

- Together, Suffolk and Nassau counties accounted for almost 1 in 5 foreclosures in metro New York

- Queens overtook the two counties to become the metro’s most active market with 165 first-time filings, despite a 14% Y-o-Y slowdown

- Despite the metro’s New York markets slipping 6% Y-o-Y, Manhattan and the Bronx defied trends with foreclosures hitting highs not seen in 8 and 5 years, respectively.

To learn more about metro New York’s foreclosure market, dive into the full report here: https://www.propertyshark.com/Real-Estate-Reports/ny-metro-foreclosure-report/.